student loan debt relief tax credit virginia

In addition to credits Virginia offers a number of deductions and subtractions from. Financial relief is coming to more than 200000 Virginians with privately-held student loans.

The Full List Of Student Loan Forgiveness Programs By State

Virginia debt relief programs.

. Ralph Northam announced on Wednesday the payment relief. An official website of the State of Maryland. While student loan forgiveness is tax-free federally through December 31 2025 it may not be tax-free on the state-level.

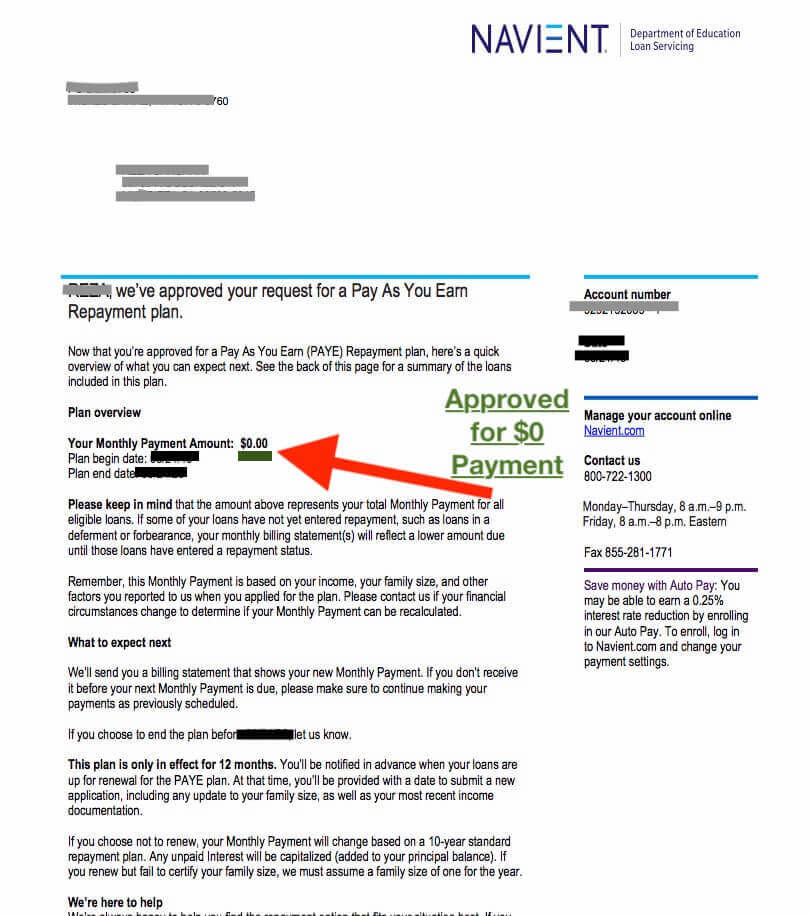

For the Classes of 2013 and later the Law Schools revised loan forgiveness program VLFP II helps repay the loans of graduates who earn less than 75000 annually in public. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. PAY DOWN YOUR DEBT.

If the child is under the age of 6 the parent can potentially receive up to a 3600 credit. It was established in 2000 and has been an active member of the. A tax refund provides the opportunity to improve your financial situation.

Find debt relief programs in Virginia and learn about the statute of limitations debt collection laws and debt statistics in Virginia. Payday lending laws in Virginia. About the Company Vehicle Tax Relief Virginia.

Information related to the requirements referenced in. Debt resolution is a debt relief option that has become increasingly popular among people who need relief from high-balance credit cards typically 20000 to 125000 or more. CuraDebt is a company that provides debt relief from Hollywood Florida.

Use your refund for some much. If a student has 18000 in loans with a standard 10-year repayment and 6 interest how much will that students payments be each month. In fact prior to the American Rescue Plan Act of 2021.

Your First Step to Financial Freedom. On December 13 2018 the Department of Education announced it would be wiping 150 million in student loans for 15000 borrowers whose schools closed on or after Nov. 46th and current president of the United States.

Blanket forgiveness of student loans as President Joe Biden appears poised to offer would be a huge mistake. Review the credits below to see what you may be able to deduct from the tax you owe. It allows you to claim 100 of the first 2000.

The student loan debt crisis is growing and only getting worse. Debt collection in Virginia. Filing for bankruptcy in Virginia.

Student Loan Debt Relief. Student Loan Debt Relief. Tips to tackle debt in Virginia.

This refundable tax credit is for families with qualifying children. The American Opportunity Tax Credit is available for first-time college students during their first four years of higher education. Under legislation enacted by the General Assembly Virginias date of conformity to the federal tax code will advance to December 31 2021.

Practical Suggestion for Tax Refund. Posted by 5 minutes ago. Talk to a certified debt specialist.

Use these tips to get the most value from your refund check. In this scenario the student would be. And if the child is.

Biden just wiped out student debt for all remaining student defrauded by for-profit Corinthian Colleges. See Guidelines for the Education Improvement Scholarships Tax Credit Program Effective February 7 2020-This is a Word. Patty Murray lauded the relief and said it should be provided to.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. STUDENT LOAN DEBT RELIEF TAX CREDIT. See Tax Bulletin 22-1 for more information.

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Student Loan Forgiveness Help Relief Find Out If You Qualify

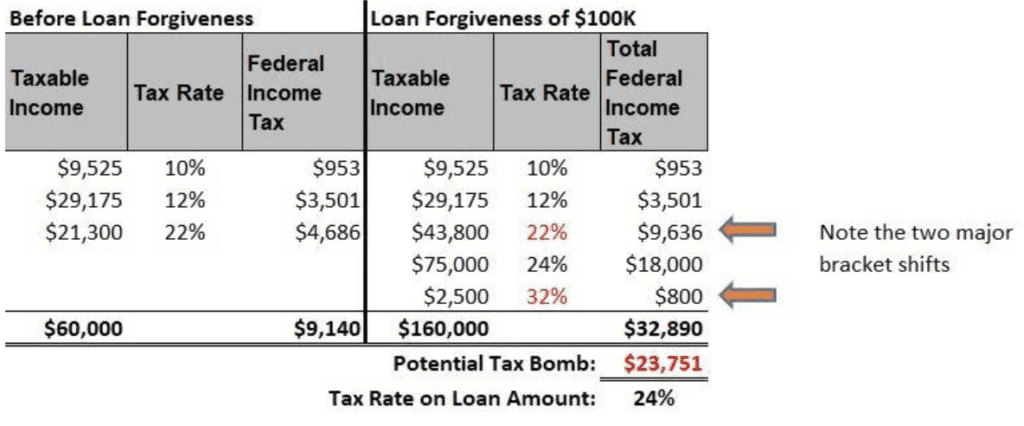

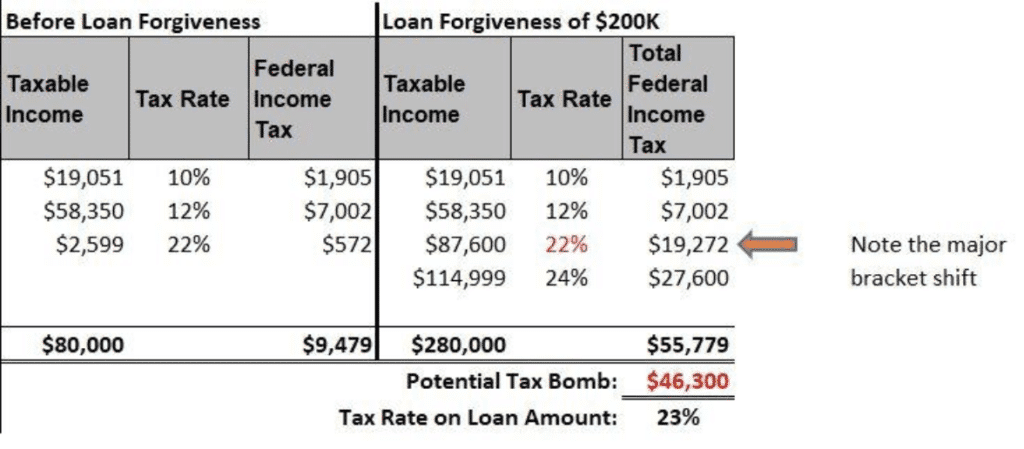

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Texas Debt Relief Programs Get Nonprofit Help For 2k 100k

Biden Has Forgiven 9 5 Billion In Student Loan Debt Money

Student Loan Forgiveness Programs The Complete List 2022 Update

Student Loans May Qualify For Federal Forgiveness

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

New Options For Student Loan Forgiveness

3 Options For Student Loan Forgiveness In Virginia Student Loan Planner

Governor Hogan Announces 9 Million In Additional Tax Credits For Student Loan Debt Wdvm25 Dcw50 Washington Dc

Latest White House Plan Would Forgive 10 000 In Student Debt Per Borrower The Washington Post

Virginia Student Loan Forgiveness Programs

Learn How The Student Loan Interest Deduction Works

Virginia Ag Miyares Secures Student Debt Relief From Defunct For Profit College Wavy Com

Biden Administration Resists Democrats Pleas On Student Debt Relief As Deadline Nears Virginia Mercury

Who Owes The Most Student Loan Debt

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner